When analysing good companies it is often easy to forget the importance of price and its relation to investment risk. Seldom do even the strongest companies prove to be good investments if too high a price is paid.

MTR Corporation (0066.HK) is a world-leading railway operator with an expansive network of 87 stations covering 220km of Hong Kong countryside. MTR boasts a staggering 48.4% share of the Hong Kong franchised public transport market. The company’s combined railway and station operations account for c.65% of its recurring earnings. These operations are separated into two revenue streams; fare revenue and station commercial business revenue. The remaining c.35% of recurrent earnings comes from MTR’s Hong Kong rental property division, consisting of a portfolio of shopping malls and offices. MTR also operates a property development business that contributes a substantial, yet non-recurring, amount to earnings. Finally, MTR operates railways in mainland China, Australia, and Sweden that contribute c.5% of earnings – an inconsequential segment in the scheme of things. With the company sitting on c.24x underlying FY17e earnings, investors must ask themselves; does MTR deserve a growth multiple?

Fare Revenue:

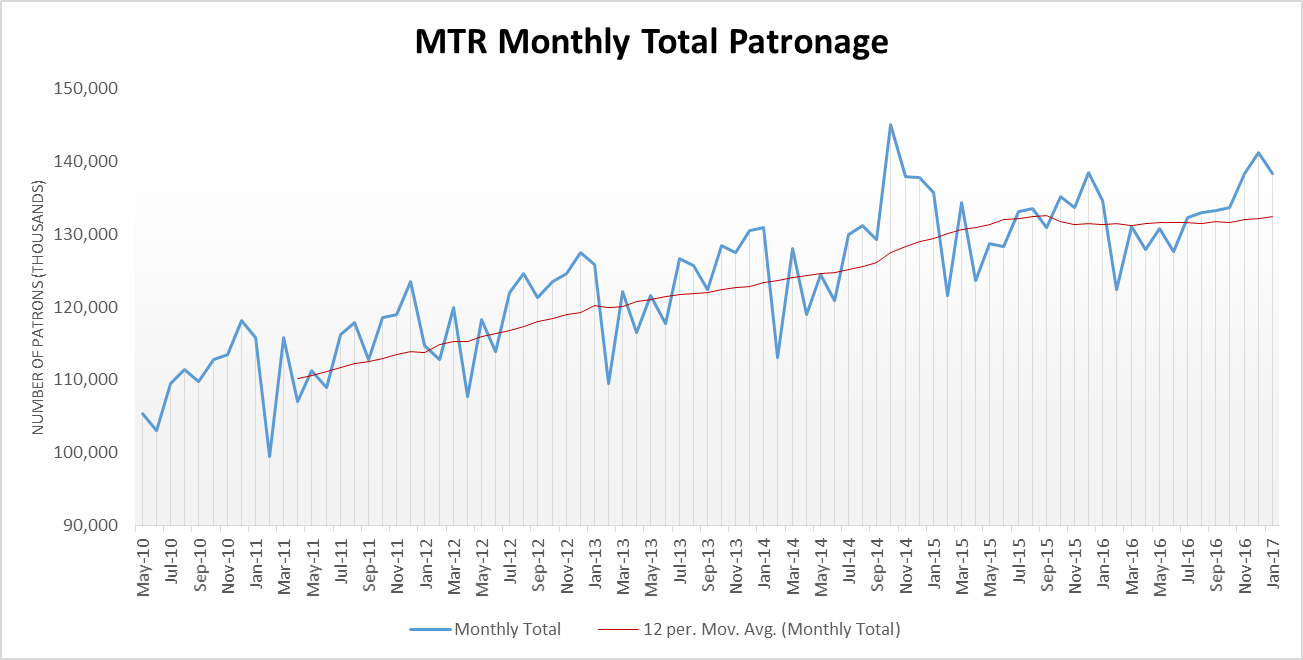

The first component of MTR’s transport operations, fare revenue, contributed c.HK$17.7bn in FY16, with a contribution margin of c.14.6%. Put simply, fare revenue is a function of the number of patrons using MTR transport and the fare prices they pay. Over the last two years, patronage at MTR has plateaued. The number of MTR patrons grew 1.8% in 2015 and slowed to just 0.5% in FY16, bolstered by openings of the Kwun Tong Line Extension and the South Island Line. Whilst a full year contribution of the new lines will increase patron growth in FY17, we expect the added c.HK$1bn per year of depreciation cost to more than offset this growth and likely further compress margins. For some perspective, HK$1bn in added depreciation costs is equal to c.15% of MTR’s FY15 Hong Kong railway operation earnings.

Fare prices – the other factor in transport revenue – are adjusted on an annual basis using the Fair Adjustment Mechanism (FAM), with the mechanism itself being reviewed every few years. The FAM is calculated by taking equal parts CPI and transport wage inflation, with a Productivity Factor then deducted. The most recent FAM review in March of this year determined that a Productivity Factor of zero was appropriate. It is important to note that the Productivity Factor is a derivative of MTR’s railway margins, meaning that the company’s Hong Kong railway operations have experienced no margin expansion over the last four years! A special adjustment of negative 0.6% has been added to the mechanism to match the previous Productivity Factor. Combined with the muted outlook for patron growth and added depreciation costs, fare revenue seems an improbable driver of earnings growth in FY17 for MTR.

Station Commercial Business Revenue:

MTR’s commercial station business is the remaining component of Hong Kong railway operations. This segment consists of revenue from rent paid by station retailers, advertising and telecommunication services. The segment has provided MTR with strong earnings momentum in the past, with revenue growing at a CAGR of c.12% from 2011 to 2015. More recently, however, this momentum has begun to fade. Revenue growth for FY16 was just 3.0% with EBIT margins flat. Amidst tough economic conditions in Hong Kong, we expect growth in FY17 to remain subdued. In aggregate, we expect for MTR’s railway operations, including both fare and commercial station revenue, low single-digit to flat growth. Given these operations account for c.65% of the company’s recurring revenues, this certainly doesn’t bode well for the growth thesis implied by the company’s multiple.

Property Rental Business:

The remaining c.35% of MTR’s recurring revenues come from its property rental business. MTR Corporation owns a portfolio of shopping malls as well as 18 floors of the Two International Finance Centre office building. Growth in rental revenue has begun to slow, with rental reversions in the shopping mall portfolio averaging just 3.4% in FY16, down from 12% in FY15. Whilst MTR has stated that they plan to increase their portfolio gross floor area by 40% over the next 5 years, there is no clear catalyst for property rental earnings growth in the near-term.

MTR Corporation also operates a Hong Kong property development business that partners with companies to develop residential buildings along its railway lines. This is a lucrative, yet lumpy, segment for the company. In FY16, MTR reported a modest profit of HK$311m in this segment, down from HK$2,891m in FY15. With the bulk of its pipeline scheduled beyond 2017, investors should expect another modest contribution from this segment in FY17. MTR does have some upcoming tenders to be announced by year-end, though the lack of disclosure surrounding these tenders’ profit-share ratios can inhibit meaningful interpretation. It is only after a development has been completed, several years after its tender, that the profit-share ratio, and thus the materiality of the tender, can be assessed. It is important to note that the estimated c.24x FY17e multiple includes a normalised contribution from the property development business.

Towards the more anecdotal, there have recently been reports from local newspapers of an HK$20bn cost overrun on the Sha Tin-Central Line (SCL) project, representing a blowout of more than 25% over the initial budget. Whilst not exactly concrete evidence, cost overruns are fairly common, and the company has already forecast an additional HK$4.1bn over the budget due to archaeological finds at one of the sites. As a precedent, the recently delayed Express Rail Link (XRL) has seen cost overruns of HK$19bn over an initial budget of HK$65bn. Although the government has agreed to cover the initial XRL overrun, MTR Corporation is liable for any costs exceeding this new budget.

A further condition of the agreement was for MTR to distribute a special dividend of HK$4.40 per share to be paid in two tranches. As the government owns c.75% of MTR, this scheme essentially returns the HK$19bn paid by the government and puts a severe strain on MTR’s already levered balance sheet. Given the SCL is approximately 60% complete, these reports could drastically underestimate total cost overruns for the project, with arbitration over who covers the cost likely to be less congenial than in the case of XRL.

Conclusion:

MTR Corporation is an undeniably strong business with a stable recurring earnings base. Sitting on its current multiple the company is, however, priced for perfection. With no clear growth prospects on the horizon and some formidable catalysts on the downside, MTR is destined to disappoint. The company sits on a dividend yield of c.6.90%, bolstered by a special dividend payment coming in the second half of 2017. Removing this special dividend payment reveals an underlying yield of just c.2.45% – significantly lower than its peers on an average dividend yield of 3.30%. This suggests that MTR trades at a c.34% premium to its peers. MTR’s balance sheet is under tremendous stress, with the payment of the second special dividend tranche likely extending MTR’s net debt-to-equity ratio beyond 25%. This would be greatly exacerbated by any cost overrun on the SCL project and leaves little room for the company to increase its dividend payout ratio.

To quote Warren Buffett, ‘you pay a very high price in the stock market for a cheery consensus’. The consensus is in for MTR Corporation and it’s certainly positive. But given its limited growth prospects and downside catalysts, should MTR really be trading on c.24x underlying 2017e earnings?